Greens will penalise a core support base - renters

|

|

Dear ,

We sent the news release below out yesterday. I thought you would like to know about it as it deals with some in-depth research we commissioned on tax policies and the housing market.

You can download the research itself by clicking here.

So far we've got reasonable news coverage, given other events that were unanticipated which also occurred yesterday.

According to our polling, a hung parliament is the most likely outcome of this election with the Greens being in a position to dictate policy, so it's about time the media examined their policies, particularly as in the case of abolishing negative gearing and doubling capital gains tax, we know they have support in Labor, particularly from Treasurer Jim Chalmers.

News release

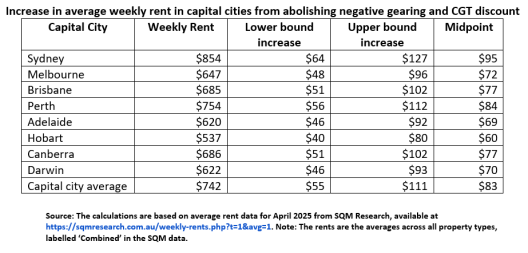

The Greens balance of power demands to abolish Negative Gearing and double Capital Gains Tax on rental properties, will add $83 a week to average capital city rents on top of normal increases, according to new independent modelling.

The research by Adept Economics also finds that based on international experience, the Greens calls for rent caps could prompt 450,000 rental properties to be withdrawn from the Australian market.

The modelling, commissioned by the Australian Institute for Progress, predicts many landlords will sell rental properties, reducing their availability, while those that remain will be forced to seek higher rents to compensate for the tax changes.

Graham Young, AIP Executive Director, said that the housing crisis now affects renters more than home owners, many of whom have made handy profits over the last few years. “ABS figures show that rents have increased by 24.6% over the last three years, almost twice the rate of general inflation, and with house prices so high more Australians than ever are locked-out of home ownership and trapped in rentals,’’ Mr Young said. “Renters are the new victims of housing unaffordability. Making it more expensive for purchasers to afford investment properties will only make their plight worse.” The Greens have demanded the axing of negative gearing and capital gains tax concessions as well as rent caps as the price for the party’s support for supply and confidence in a hung parliament. The modelling calculates the abolition of Negative Gearing and Capital Gains tax concessions will cut the return on investment for rental properties by between 13–16%. The initial short-term impact of the changes could be lower property price appreciation than otherwise in the year it is implemented. “Removing negative gearing and doubling the CGT would result in higher rents over the long term,’’ Adept Economics Director Gene Tunny said. “This is because removing negative gearing and doubling CGT paid would significantly reduce the return on investment in property for investors. “This will likely result in a significant reduction in the supply of rental properties.” Mr Tunny warns significant rent increases could materialise within two years as landlords seek to compensate for higher costs, with the modelling predicting rents could be 11% higher than they would otherwise be. This equates to $60–$95 a week higher in capital cities based on current asking rents, with an average of $83 a week. Given the low vacancy rate in the rental market, the modelling expects the impact of the higher costs created by the abolition of negative gearing and capital gains tax concessions to be passed on through rents more easily than previously.

‘Furthermore, Australia is currently tracking well below the level of dwelling completions necessary to meet the national housing target (ie 240,000 or 60,000 a quarter) meaning there is an even greater challenge to ensure sufficient rental supply in the future.’’ Mr Tunny said some Australians may be better off because the rate of owner occupation may increase. “But those stuck in the rental market would be significantly worse off,’’ he said. Rent price caps failMr Tunny cites two case studies which suggest rent price caps have failed in the United States and Argentina. In San Francisco rent controls led to a reduction in available rental properties in rent-controlled buildings by 15%. “This is likely indicative of the potential impact of rent controls in Australia,’’ Mr Tunny said. “Given around 3 million households are renting their dwellings, rent controls could mean the withdrawal of around 450,000 dwellings affecting 450,000 households.’’ In Argentina, 45% of landlords exited the market after the imposition of its 2020 rent control laws, while Airbnb listings in Buenos Aires surged from 10,000 to 29,500. Average monthly rents for a two-bedroom apartment increased from 18,000 pesos in 2019 to 334,000 pesos by 2024. Following the repeal of the controls in 2023, traditional rental listings rose 50% by January 2024 and new rental prices fell 20–30%.

|