|

|||||

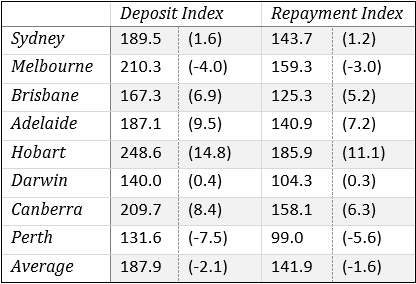

The latest Australian Institute for Progress Housing Affordability Index shows housing affordability moderated slightly in the September Quarter, 2021. This was as a result of price falls in Melbourne, while they stayed almost stationary in Sydney. Does this signal a reverse in the housing market, a pause before continuing, or are purchasers rotating out of the most unaffordable markets into the more affordable ones? Executive Director Graham Young said that the average figures are deceptive. “There is not one but 8 major city housing markets in Australia. They act independently in some ways, but there is also an interconnection. “Affordability improved marginally in Melbourne and was almost stable in Sydney. This is because prices moderated. ABS figures also showed there was a decrease in transfers in the major capital cities. “So the moderation would appear to be caused by buyers stepping back rather than an increase in supply to meet demand.” Mr Young said this could indicate a number of things, which warranted further investigation. “The biggest decline was in Melbourne, which saw a decline in sales of 44% on the previous quarter, and, on our figures, the least affordable major city. Canberra which is next least affordable had a 48% decline in sales. “Hobart, the least affordable of the smaller cities also experienced a huge decline in sales of 38%. “By contrast the more affordable cities of Adelaide and Brisbane had smaller declines in turnover of 8% and 13% respectively.” Mr Young said Perth, which is the most affordable capital had a 25% decline in turnover, while Darwin with similar affordability suffered only a 9% decline. “Perth looks to be an outlier, with the property market there being influenced by a different range of factors to the other markets.” Mr Young said that speculatively it appears that prices and volumes in the most expensive markets are responding to affordability, while the more affordable markets are continuing to grow in price, but with reluctance from buyers. It is also likely, and backed-up by anecdotes, that some of the buying pressure in Melbourne and Sydney is being diverted into Brisbane, Adelaide and Hobart. Affordability in those markets, even though in the case of Hobart it is unaffordable for locals, is good for home purchasers arbitraging from the more expensive interstate markets. It is also possibly the case that when the economy returns to normal once COVID is accepted as being endemic, that the moderation in Melbourne and Sydney will be shown to be a pause, not a turning point. To download the report click here. For further information contact Graham Young 0411 104 801 or graham.young@aip.asn.au. |

|

||||

|

|||||