|

|||||

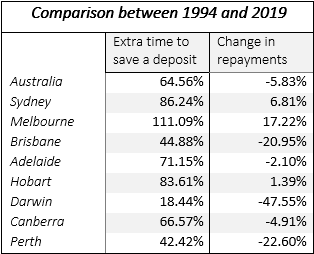

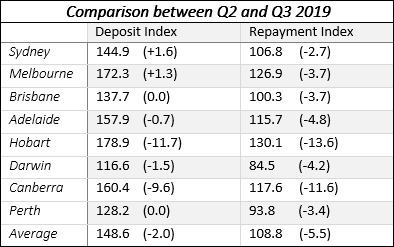

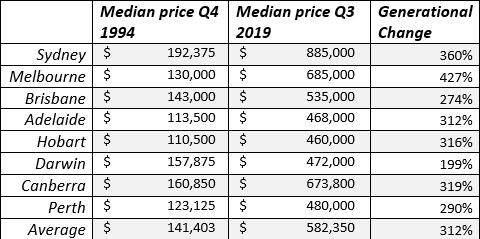

Millennial home buyers have it almost as good as their parentsEmbargoed until midnight Thursday 19 December , 2019 The Australian Institute for Progress Housing Affordability Index shows that the average house repayments are 5.83% more affordable than they were for the parents of this generation 25 years ago. To download the report click here. However it does take longer to save a deposit, with a 20% deposit taking 64.56% longer to save. Executive Director of the AIP Graham Young said that there has been a change for the better in housing affordability for those with a deposit. The problem is affording the deposit and government policy needs to address that. “The Federal Government’s Deposit Guarantee scheme is a step in the right direction, as it allows a smaller deposit to be used, reducing the time taken to save. “This would be particularly useful in the cheaper markets of Darwin, Perth and Brisbane where mortgage repayments are 47.55%, 22.60% and 20.95% more affordable respectively. “It could be dangerous in Melbourne where repayments are 17.22% less affordable; and a strategy to be used carefully in Adelaide (2.10% cheaper), Hobart (1.39% dearer) or Sydney (6.81% dearer).” Mr Young said another policy which would be beneficial would be to allow first home buyers to access their superannuation savings to finance their deposit. “The government allows limited access to voluntary super contributions for this purpose, but this is insufficient, and will probably just redirect deposit savings from the bank to the superannuation fund. “What is needed is access to the compulsory part of super. At 9.5% of income it is a substantial savings on its own, and the most important part of any retirement policy should be ensuring home ownership. “At the moment government policy is working against retirement needs.” Mr Young said that the index also showed the relative performance in housing over that period, with Melbourne moving from more affordable to less affordable than Sydney. “Since 1994 Sydney prices have appreciated 360%, while Melbourne prices appreciated 427%. “Out of the mining states, Perth median house prices increased 290% while Brisbane was up 274%. The wooden spoon goes to Darwin which increased only 199%.” The report also showed that there had been a slight improvement in affordability between the 2nd and 3rd quarters this year, which has probably led to the reportedly buoyant market in the last quarter of this year. For further information call Graham Young on 0411 104 801 or email graham.young@aip.asn.au.

|

||

|

|||||