|

|||||

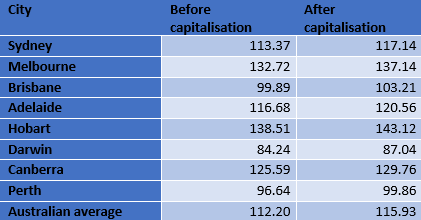

Capitalising interest into loans makes sense at the momentHome buyers can afford banks’ generosityModelling by the Australian Institute for Progress shows that homeowning Australians have a financial buffer in the equity in their house that they can safely use to tide over the short-term interruption caused by COVID-19. Releasing their latest housing affordability index (to download click here), AIP Executive Director Graham Young said Australian housing is historically affordable for those who can find a deposit to get into the market. The index is at 112.85, its second lowest point for sixteen and a half years. Using the December quarter figures from the ABS (the latest available) the institute modelled the situation for a new homeowner who suspended repayments for a period of 12 months. “What we found was that as long as the mortgagee was flexible in terms of security ratios, judged on the history of the last 26 years the home owner should be able to self-finance a 12 month payment holiday by capitalising interest and adding it to their mortgage. “Our figures are based on the December quarter, so the recent drop in interest rates will only improve the situation. “If you increased the mortgage by a full year’s worth of interest payments the index figure rose to 115.93. That still leaves it more affordable than most of the period back to 2003, and almost indistinguishable from the index figure in the December quarter of 1994 of 115.49.” Mr Young said the index is based on 80% borrowings and there would be a small blow out in the loan security ratio to 83%. “This still leaves the borrower with plenty of equity, as long as the housing market does not collapse. If banks are flexible this should not happen. It will only happen if homeowners are forced to sell. “Of course the sums are not the same in all cities. The table below suggests the cities where it is safest to use this option are Sydney, Brisbane, Darwin and Perth, which are all at historically quite affordable levels.”  Note: An index figure of 100 means a housing loan is at the same level of affordability now as it was in the 10 year period from 1994 to 2004. For further information contact Graham Young 0411 104 801 or graham.young@aip.asn.au |

||

|

|||||