The Australian Institute for Progress launched its report into Australian attitudes to taxation today. The report can be downloaded by clicking here.

It is not good news for those who believe tax rates ought to be lower with more than 50% of respondents being prepared to pay more tax themselves – in some cases by an increase of more than 10%.

The study was based on responses from 1,568 members of our 13,000 strong online panel, which was then balanced to ensure it was politically representative.

We received coverage in the Courier Mail with a double page spread on pages 4 and 5. Findings of the report included:

We received coverage in the Courier Mail with a double page spread on pages 4 and 5. Findings of the report included:

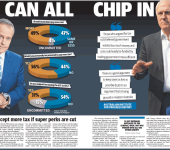

- Most significantly 56% said they were prepared to pay higher tax. While Greens (75%) were the most generous, even 46% of Liberal voters said they were prepared to pay more.

- 48% of respondents were happy to pay more tax, while 47% wanted to pay the same or less. Those in favour of higher taxes ranged from 74% of Greens down to 33% of Liberals

- As a percentage of GDP, 32% said we should pay more than at present (26% of GDP), suggesting a different attitude, 10% what we pay at present, 37% somewhere between (18% and 26%), with 12% for 18% of GDP or less. Again support for higher taxes was highest on the left.

- When asked whether we should be more like particular countries, with the countries being linked to their tax rates, 23% opted to be like top-taxing Denmark, 21% thought the UK or NZ more appropriate models, 25% said we should stay the same, and 21% thought we should be more like Hong Kong.

- 44% thought that assets in superannuation should be capped, but only 34% thought super payouts should not be able to be taken as a lump sum.

- There was not much enthusiasm to changes to company tax with 23% thinking it should be higher and 27% lower, with 40% looking for it to be maintained at current rates.