There is a good argument to keep taxes as low as possible. It’s an argument that is losing ground in modern Australia.

None of Australia’s major political parties are unequivocally lower tax. Labor and Liberal may pay lip service, but both are considering overall tax increases, while the Greens are unapologetically higher tax.

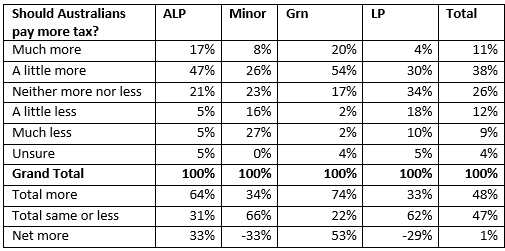

We polled our online panel about their attitudes to tax. 74% of Greens voters and 64% of Labor voters were in favour of increasing tax rates. This was almost offset by the 66% of minor party voters and 62% of Liberal voters who wanted the same amount as now, or less.

So, the tug of war between status quo and increase is evenly poised. But when you look at the contrast between those who want lower taxes and those favouring an increase the maths changes drastically. 48% of all voters are prepared for a tax increase, but only 21% want a decrease.

Measured like this more Liberal voters are in the higher tax camp (33%) than in the lower tax one (28%), leaving minor party voters the only ones where higher tax (34%) was outweighed by lower tax (43%).

That explains why neither Liberal nor Labor are looking to cut the tax burden – the constituency just isn’t there to support it. The need to get preferences from minor party voters may influence the Libs to make lower tax noises, unlike the ALP who have to obtain Greens preferences.

Of course things are more complicated than that. Just because I might think Australians should pay more tax it doesn’t mean I think all Australians should pay more tax, or that I am one of those who should.

Of course things are more complicated than that. Just because I might think Australians should pay more tax it doesn’t mean I think all Australians should pay more tax, or that I am one of those who should.

The major arguments in favour of increasing tax were that some were not paying their “fair” share, particularly companies, and multi-national companies, but also richer Australians. Within the group that supported an increase there was support for lowering the tax on some Australians, at the same time increasing it on others.

There was also a perception that the tax take had to rebalance after the Howard years when a large number of voters thought the proceeds of the mining tax had been squandered on tax cuts. Amongst those wanting tax cuts the strongest argument was that government wasted too much money and that cuts could easily be funded by making government more efficient.

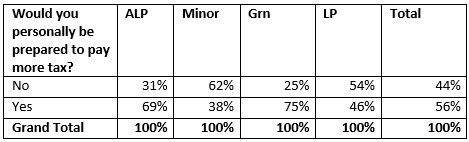

To be more scientific about this we asked voters whether they would be personally prepared to pay more tax. And we found that 56% were prepared to pay more versus 44% who wouldn’t. Again opposition was concentrated in minor party voters, where only 38% would pay more. Even 46% of Liberal voters were prepared to pay more.

Interestingly this suggests that Liberal and minor party voters are more altruistic than they think the country should be, as only 34% of both groups thought the country should pay more. It could also be a wealth effect. We don’t capture the full gamut of income groups, with our surveys skewing towards the better off who may be prepared to be more generous with their tax than Australians who are just scraping to get by.

And it is one thing to be prepared to pay more tax, and another for that to be a significant amount, so we asked how much those who were prepared to pay more would pay.

And it is one thing to be prepared to pay more tax, and another for that to be a significant amount, so we asked how much those who were prepared to pay more would pay.

The results were quite startling. While 60% were prepared to pay between 0% and 5% more of their income in tax, 13% said they would pay more than 10% and a further 13% said they would pay between 5% and 10% more of their income.

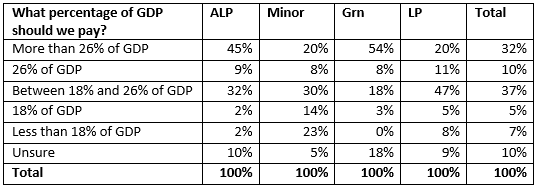

We also tried to get a better handle on how respondents thought by putting Australia’s tax rate in an historical and international perspective. These results diverge a little from the figures above.

Currently Australian taxation amounts to 26% of GDP, while within the last 60 or so years it has been as low as 18% of GDP. So we asked respondents where it should be along that time line, or whether it should be higher than 26%.

Phrased like that, the 48% who thought tax should be increased shrank to only 42%. The lower tax camp, increased to 49%, and the status quo was only 10%.

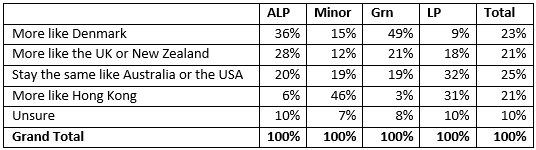

We also sit below the median for total tax, so we asked voters whether they wanted to be more like top taxing Denmark, lowest taxing Hong Kong or a range of countries in-between. We gave them the total tax rates: Denmark, 49%; UK 39%; NZ 34.5%; USA 26.9%; Singapore 14.2%; and Hong Kong 13%. Now we get 44% of respondents wanting higher taxes versus 49% in our first question asking whether Australians should pay more tax. At 49% of GDP Denmark would have to fit most criteria of “much more”. In this question 23% of respondents think we should tax at the same rate as Denmark, versus only 11% who say “much more” in our first question. At the other end of the scale Hong Kong would have to qualify as “much less”, and it gains 21% support versus only 9% for “much less” in the first question.

We also sit below the median for total tax, so we asked voters whether they wanted to be more like top taxing Denmark, lowest taxing Hong Kong or a range of countries in-between. We gave them the total tax rates: Denmark, 49%; UK 39%; NZ 34.5%; USA 26.9%; Singapore 14.2%; and Hong Kong 13%. Now we get 44% of respondents wanting higher taxes versus 49% in our first question asking whether Australians should pay more tax. At 49% of GDP Denmark would have to fit most criteria of “much more”. In this question 23% of respondents think we should tax at the same rate as Denmark, versus only 11% who say “much more” in our first question. At the other end of the scale Hong Kong would have to qualify as “much less”, and it gains 21% support versus only 9% for “much less” in the first question.

So contextualising tax rates in terms of countries has a significant effect on how people think of them.

There are a few options being considered as to what taxes might be increased. We didn’t look at all of them.

There are a few options being considered as to what taxes might be increased. We didn’t look at all of them.

We did look at GST, which is now moot as no one supports increasing this tax, apart from a few state premiers. It is plain why this went off the boil. Only Liberal voters were in favour of an increase with every other group, including minor party voters, strongly opposed. So it appealed to the base, but was poison with all the other groups, including those the government needs preferences from.

Another area sometimes mentioned as ripe for a tax cut, or a tax increase, is company taxation. We discovered a very low level of interest in either proposition. Across the sample 40% thought it should stay where it is, with this being essentially the same figure for Labor, Liberal and minor party voters. Greens voters on balance would like to see an increase (50% increase versus 11% decrease), and ALP voters are similarly inclined but less enthusiastic (36% versus 10%).

However, this is a policy that might get traction as Liberal voters on balance support lowering (10% against versus 40% for) and minor party voters are even more inclined (11% against and 46% for).

Limits on the amount of money that savers can have in a superannuation account are likely to be well received. Or the corollary of that – that concessions diminish over time so that large amounts aren’t advantaged.

There was a feeling amongst respondents that any saving for retirement ought to be rewarded and that saving for retirement is rare. At the same time they didn’t think the already advantaged ought to be more advantaged by the system, and they worried that if the government limited contributions to give a “comfortable” standard of living the government’s idea of “comfortable” would be very meagre.

There has also been some suggestion that superannuation should only be able to be taken as an annuity, rather than a lump sum. 40% agreed with this proposition and 34% disagreed. 22% were neutral. There is scope for the government to have an argument on this issue, but to win they would need to pick up a lot of the neutrals.

While there were a lot who thought it was wrong to blow a superannuation lump sum and then go on the pension, there were others who recognised using it to pay off a mortgage was a sensible approach that would help to ward off poverty in old age. There was also a strong feeling that superannuation is private property, and the government has no business telling individuals what to do with their wealth.