|

This morning an Australia Institute spokesman claimed that Queensland derived more income from motor vehicle registrations than it did from coal royalties.

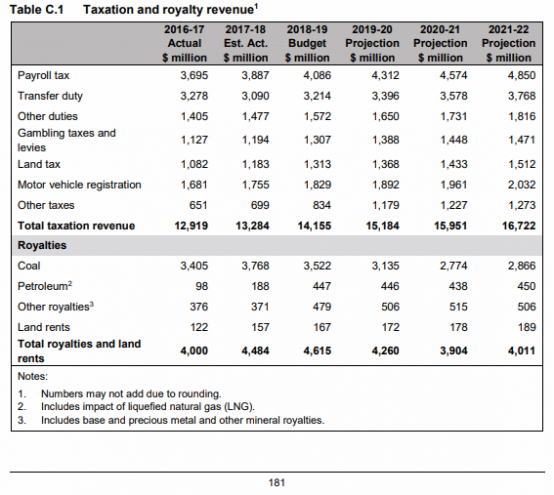

This is emphatically wrong, as shown in Table C.1, taken from the Queensland Budget Papers 2018/2019 and displayed to the right (to view a larger table, click on the image).

In 2016/17 coal royalties were 206% of MV registration, and in 2017/18 215%. This year coal royalties should be 193% of registrations.

This is yet another example of the Australia Institute peddling false information.

Production and export of coal is a significant boon to the state economy, contributing approximately 20% of total taxation and royalty income, and is similar in size to payroll tax and stamp duty.

Without coal royalties other taxes and charges would need to rise by an average of 20%, or expenditure on infrastructure and services cut.

Quote: “The Australia Institute is one of a number of organisations involved in a war on coal. Fair enough, that is their right. But in war, truth is often the first casualty, which is what we are seeing here.” Graham Young