Our brand new housing affordability index reveals that even though the latest available ABS figures (December 2018) show a drop of 2.4% in average house prices in the last quarter of last year, houses were actually 1.2% less affordable at the same time

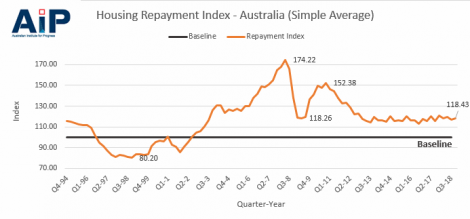

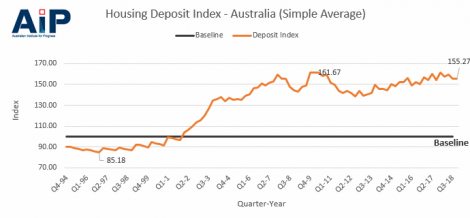

The AIP Housing Affordability Index measures affordability based on repayments, rather than house prices. It also measures the time taken to save a 20% house deposit as a measure of affordability that primarily affects first home buyers.

To download the report click here.

According to AIP Executive Director Graham Young the decrease in affordability was due to a slight increase in interest rates at the time and fluctuations in weekly earnings which cancelled out the fall in house prices.

For the same reasons the time it took to save a deposit was virtually unchanged over the period.

“According to our figures housing affordability on average, measured by repayments, has moved sideways now for 5 years, since the first quarter in 2013, but the time taken to save a deposit is close to historical highs with a rising trend since 2012.

“But as no one is average, the averages hide considerable variation between cities.

“But as no one is average, the averages hide considerable variation between cities.

“Sydney became markedly more affordable during the quarter with a 3.01% change in repayment affordability, while Canberra and Hobart became much less affordable, moving by 4.34% and 4.30% respectively,” Mr Young said.

Mr Young said that in historical terms Darwin was the most affordable, for repayments with an index figure of 96.8, making repayments similar in relative terms to the 1990s.

Perth (100.5) and Brisbane (105.2) were also as affordable as the 90s, while Melbourne is significantly more expensive than the 90s with an index of 140.1, 40.1% higher in relative terms.

“The implications of these figures are that house prices could stabilise at this level as Australians have shown over the last generation that they are prepared to buy at this level of repayments or higher.

“What could change that is a fall in wages, or an increase in interest rates.

“And the problem of saving for a deposit is still an issue for first home buyers who will spend around 55% longer saving for a deposit than their parents’ did.”

“And the problem of saving for a deposit is still an issue for first home buyers who will spend around 55% longer saving for a deposit than their parents’ did.”

Note: The AIP index is based on repayments which is the most appropriate measure of affordability. As recent work by the RBA shows, house price rises are largely a rational response to decreased borrowing costs.