Bill Shorten claims that corporate profits are rising much faster than wages, claiming “39 per cent is the increase in corporate profits since you last voted for Malcolm Turnbull. Wages have moved 5 to 6 per cent.” Not only is this not true (the vagueness of the “5 to 6 per cent” gives this away, but it is an outrageous cherry-pick.

By arguing that corporate profits are too high Shorten is rejecting Labor’s history. The Hawke government’s Prices and Income Accord with the ACTU was based on increasing the share of the economy that went to corporations so that they could save and produce, thus lifting economic growth, employment and wages.

Shorten is opting for a populist pitch aimed at voters who do not understand how they have come to enjoy their current standard of living. Download our latest “Fact Bite” on the issue by clicking here.

The facts are:

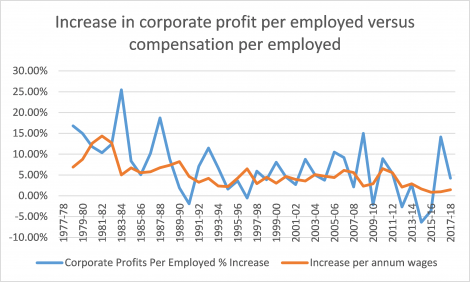

- At no time has there been a 39% increase in profits while wages have only increased “5 or 6%”. In the 11 quarters since the 2016 election, up until December 2018 (the latest available), there has been an increase in corporate profits per worker of 36% and 4.3% in wages. Both fall short of his claims.

- The figures have been cherry-picked. Quarterly figures are incredibly volatile, so not to be relied-upon on their own. The September quarter was a low point for company growth after decreases of 3.56% and 6.34% in the preceding years. The growth in company profits is an artifact of an exaggeratedly low starting point.

- Corporate profits per employed and compensation per employed since 2013-14, the year Labor lost and up to 2017-18 you find that profits increased by 7.47% and employee compensation by 5.08%.

- By campaigning to increase wages and decrease corporate profits Shorten is reversing the policies of the Hawke and Keating governments which introduced the Prices and Incomes Accord to reduce wage increases, and increase corporate profits and savings.

- Mr Shorten’s policy is likely to increase the level of unemployment.

- Over the last 10 years the ratio of corporate profits to personal earnings has been lower (“worse” in Mr Shorten’s terms) than it has been under the Coalition, including when Mr Shorten was the Minister for Work Place Relations.

- The share of the economy held by wage income is currently comparable to what it has been all through the last 30 years, the time in which Australia has experienced unprecedented growth. Compulsory superannuation also means that workers receive a benefit from higher corporate profits through their retirement savings and earnings.

- Company profits are more volatile than wages, effectively acting as an economic shock absorber. As a result they will decrease and increase much faster than wages. Such a decrease and increase happened in the last 4 years. But on average the change is similar between wages and corporate profits.

- Australia needs corporate profits to increase to provide the basis for a sustainable increase in economic growth, wages and employment.