According to our housing affordability index, house repayments across Australia were at their lowest level for 16 years in the second quarter of this year, according to the latest ABS figures, but the average first home buyer is waiting an additional 15.12 weeks to save a deposit. Which means it is probably a good time to buy a house, if you can wait long enough.

This effect is created by house prices increasing an average of $12,788 while interest rates decreased 43 basis points and average weekly earnings increased by $22.

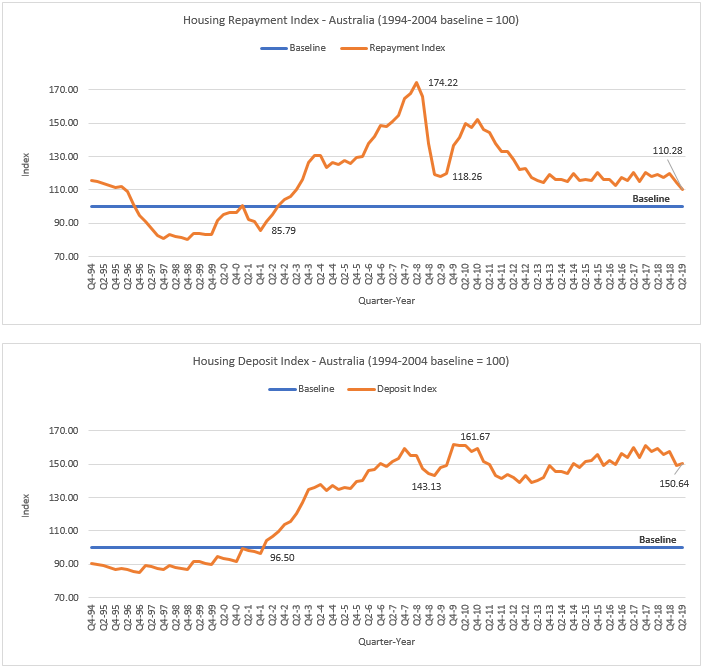

Compared to the 90s, which has an average base of 100 in our index, the repayments index was at 110.28 in the second quarter 2019, just over 10% higher. The deposit index was 150.64, significantly higher at just over 50% above the 100 base of the 90s. But unlike repayments deposit stress has been severe for years. It exceeded 150 for the first time in the fourth quarter of 2006, and has stayed there, with some fluctuations up and down, ever since.

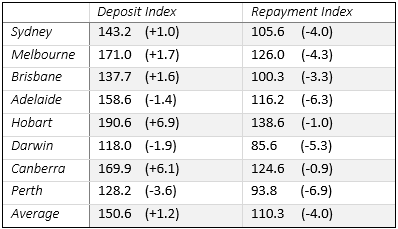

For repayments the three most affordable cities were Darwin (85.6), Perth (93.8) and Brisbane (100.3). The three least affordable on were Canberra (124.6), Melbourne (126.0) and Hobart (138.6). Sydney was a moderate 105.6 and Adelaide a more expensive 116.2.

Deposit affordability shadows repayment affordability, but while the average index figure is 150.64, Hobart is at a record high of 190.6 and has been increasing steadily since its most recent low 147.3 in 2015. Melbourne is 171 and Canberra 169.9. The three cheapest cities, Darwin, Perth and Brisbane were 118.0, 128.2 and 137.7 respectively. Sydney was just under the average at 143.2 and Adelaide just over at 158.6.

Major Findings

- Repayment costs have decreased over the 2nd quarter of 2019, with the repayment index decreasing from 114.28 to 110.28 over 2019 Q2. The cost of repayments have reached a 16 year historical low.

- Deposits costs have increased over the 2nd quarter, reversing the trend of declining deposit costs over the prior year. The deposit index increased from 149.4 to 150.64 over 2019 Q2.

- The increase in deposit costs is attributable to a rise in the Australian median house price of $12,788, while the decline in repayment costs is due to the rise in median house prices being offset by home loan interest rates falling by an average of 43 basis points and average weekly earnings increasing by $22.

- The gap between repayment and deposit costs has widened, with the rise in deposit costs being bad news for first home buyers looking to enter the housing market.