House prices moved up and affordability down

|

The latest Australian Institute for Progress Housing Affordability Index shows that average housing repayment affordability in the December quarter 2020 (the latest ABS data release) has declined slightly, but is still well-below recent lows. This means that predictions of house price increases can be accommodated without overheating the market. To download the report click here.

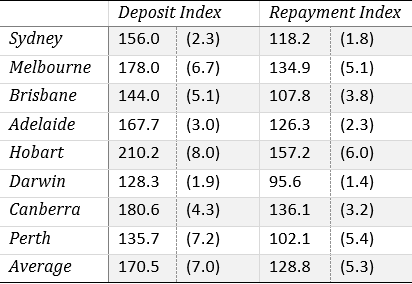

The repayment index[1] was 128.8, a deterioriation of 5.3 points and the deposit index 170.5 a deterioriation of 7.0.

While houses had become marginally less affordable, both figures were well clear of recent peaks from 2010, when the repayment index hit 155.67, or 2008 when it hit 172.2. (A higher figure means repayments or deposits are less affordable.)

This means on an historical basis that the average Australian has been prepared to pay 20% to 33% more than at the moment, which means that it is possible price increases being predicted by organisations like the CBA (16%) can be accommodated on current interest rate settings and without wages growth.

This is particularly true of Brisbane and Perth where affordability is at more or less average levels for the last 26 years.where repayments are 62% and 98% respectively below what buyers have been prepared to pay in boom times.

Deposits continue to be an issue.

It’s one thing to say that the returns on housing could be very good in the near future, but another for a first home buyer to act on that. Deposits are relatively unaffordable on an historic basis.

It’s time for he government to allow first home buyers to access their superannuation to top-up a deposit on a house or a unit.

The HomeBuilder grant has performed a valuable function in this respect, and has also directed investment towards expanding the housing stock, which will help to moderate rents, but it runs out soon.

It is inequitable that only better-off purchasers, or those with alternative sources of funding, like parents, are the only ones able to take advantage of good repayment affordability and a bouyant market.

To download the report click here.

[1] The index was constructed so as to average 100 during the period 1994 to 2004 which is used as the baseline reference point. It relates capital costs to real rates of interest and average incomes.