Our latest Housing Affordability Index shows that despite interest rate rises, house prices have retained most of their value, which has led to a decrease in housing affordability across Australia.

Our latest Housing Affordability Index shows that despite interest rate rises, house prices have retained most of their value, which has led to a decrease in housing affordability across Australia.

To download a copy of the report, please click here.

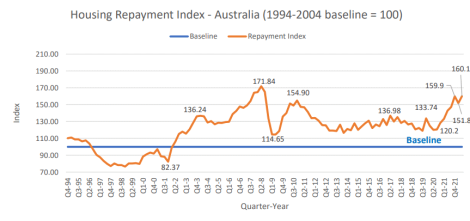

The index combines house prices, wages and interest rates to compare the affordability of home ownership over time, and 2022 is one of the most difficult times to be paying for a home.

Repayments are at a 13 year high, and almost level with where they were in 2008 just before they plunged as a result of the GFC. That was the worst time for housing affordability in the 28 years that our index tracks.

While house prices have fallen in the largest markets of Sydney and Melbourne, the falls have been outpaced by increases in interest rates. Other cities, such as Adelaide and Perth have both seen prices moving higher despite rate increases.

Brisbane’s home prices have flat-lined.

This situation would appear to be unsustainable.

On an historical basis, unaffordability peaks, it doesn’t plateau. In 2008 affordability was cured by the RBA dropping rates and it plunged back to close to the average in around 12 months.

This time interest rates are unlikely to drop, and either wages or prices, will need to adjust to make up the difference. Prices are most likely to do most of the work.”

Interest rates are projected by the RBA and most commentators to go higher, so this would likely result in lower house prices in the near term.

Interest rates are having an effect already, but so far it has been on the volume of market activity rather than the price.

Over the 12-month period between Q2 2021 and Q2 2022 (the latest available ABS figures) there has been a drop of 29% in house transfers across Australia.

This probably means that vendors are slow to meet the market and properties are taking longer to sell.

It is also probably a result of only financially very strong buyers being able to purchase a home.