Reality contradicts the “sophisticated” models

|

“Sophisticated modelling” by the Super Member’s Council released today purports to show that allowing Australian’s to access their money in their super accounts to buy a first home would inflate house prices by an average of $75,000.

According to AIP Executive Director, this modelling is rebutted by the facts.

“Sophistication in a model doesn’t guarantee a good result, and a sophisticated model can actually exaggerate conceptual assumptions to draw completely wrong conclusions.

“The Member’s Council references New Zealand where first home buyers have been able to access their Kiwisaver accounts for a deposit for a first home since 2007, but the Kiwi figures show their model to be wrong.

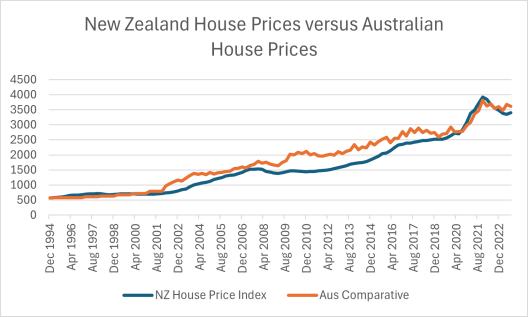

“The graph at the top of this release plots Australian and New Zealand house prices against each other using RBA and RBNZ median house price data. (To see an enlarged version click here).

“New Zealanders were first able to borrow for a deposit from Kiwisaver in 2007, yet prices went down immediately afterwards, and in fact were lower than Australia’s until 2020.

“The real world data say there is something drastically wrong with the SMC model.”

Mr Young said that the SMC claim that because fewer people in New Zealand own a home than in Australia it showed these types of schemes didn’t work was also wrong.

“Before the Kiwisaver policy New Zealand started with lower home ownership than Australia by 2.4 percentage points (66.9% versus 69.3% in 2006) but in 2018, the last year we have New Zealand data the gap had shrunk to only 1.7 percentage points.”

Mr Young said that home ownership was only part of the picture. There are issues of retirement security, equity and investment returns.

“We need a retirement policy, not a superannuation policy. While the SMC would no doubt like to manage more money the truth is that the biggest indicator of financial distress in retirement is not owning your own home, irrespective of your superannuation balance.

“We need to deal with the savings of Australians equitably. It is their money that the superannuation firms have been made the custodians of, but they have a right to use it to their best advantage.

“And the financial returns of housing over time are far superior to superannuation. The leverage involved in most house purchases gives a great return on the capital employed, when the property is sold it is exempt from capital gains tax, and the owner gets the benefit of not having to pay rent, freeing up resources for other needs.

“It’s predictable a superannuation fund lobby group would be opposed to a policy which reduced superannuation funds under management, even temporarily, but they are not doing any favours to the 10 million Australians who have $1.4 trillion in accounts with their members.

“These Australians deserve the best chance at security during the whole of their working life, as well as in retirement.”