Median house prices saw little movement across Australia over the first three months of this year, remaining relatively stable across all capital cities, with most movements limited to 0-2%, with the exceptions of Melbourne, where prices declined by just more than 3%, and Perth where prices increased by 5%.

to download the full report click here.

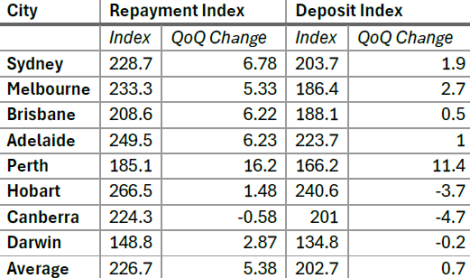

Corresponding movements are evident in repayment levels across Australia, as declining house price averages in combination with steady RBA cash rates led to small reductions in total yearly repayments on average across Australia. Specifically, the repayment index fell marginally in all capitals except Perth (5.2%), Brisbane (2.5%) and Adelaide (1.2%). Hobart also experienced a very small increase of just under 0.5% over the same period.

Using these indices as a combined measure of affordability, and as can be seen in the table below, Darwin remains the most affordable capital in Australia, followed by Perth. Hobart maintains the mantle of least affordable.