The Q4 2024 Australian housing market saw a rise in both the Repayments Index and the Deposit Index after a brief decrease in the first quarter of the year. Levels are back in line with Q4 2023 and the continued upward general trend recorded in Brisbane, Adelaide and Perth more than cancels out the decreases in Canberra, Melbourne and Hobart. Sydney remained unchanged from the previous quarter.

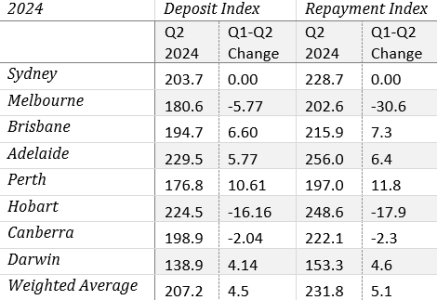

In Australia, national housing repayments increased by 5.1 index points, whilst deposit costs increased by 4.5 points.

The decrease in national housing affordability is largely the result of rising median house prices ($32,192 over this quarter), stagnant owner-occupier lending rates of 4.52%, and stagnant average weekly wage increases ($5 over this quarter).

Housing (un)affordability in Australia is almost at record levels, as house prices continue to increase (2.3% for the quarter nationally) at a pace that far outstrips wages growth with mortgage rates higher than at any point since 2011.

House price growth was underpinned by continued increases in Brisbane, Adelaide and Perth and subdued growth for a more typically flat Darwin. However continued falls were recorded in Melbourne, Hobart and Canberra. For the first time since 2018 Hobart is not the most unaffordable capital in Australia, with Adelaide beating it into second place during Q2 2024.