Why would a party whose voters are younger and disproportionately likely to rent propose policies that could see rents increase on average by another $83 per week, as well as seeing as many as 450,000 homes disappearing from the rental market?

Tagged: Housing

Easy Labour – Identifying Construction Industry Cost Drivers in Queensland

The Miles Government's Best Practice Industry Conditions (BPIC) sweetheart deal with the CFMEU is inflating costs on Queensland Government mega projects by $1 billion a year and helping to squeeze new home buyers out of the market.

Faster, Better, More: How to House Australia

Why it takes so long and costs so much to deliver the housing we need – and what we can do about it.

Crisafulli’s budget reply means we have a debate on issues, but not necessarily the right ones

Only a small part of this cost blow-out will be fixed by a regulatory review of the building industry, which, while important, will do nothing to stem the excess demand created by the government.

Government spends the smash and grab TattsLotto windfall from coal royalties to win the next election

The best predictor of future performance is past performance, and we’ve now had 9 years since Labor came to government in each of which the financial situation of the state has deteriorated.

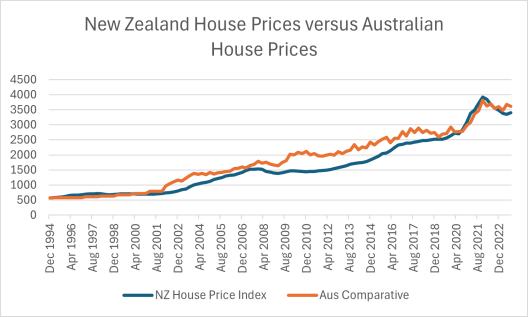

Access to super for housing deposit won’t cause house price rises

Reality contradicts the “sophisticated” models

|

“Sophisticated modelling” by the Super Member’s Council released today purports to show that allowing Australian’s to access their money in their super accounts to buy a first home would inflate house prices by an average of $75,000.

According to AIP Executive Director, this modelling is rebutted by the facts.

Housing Affordability Index Q3 2023

Overall housing is now twice as unaffordable in terms of repayments, and almost as unaffordable in terms of deposits as it was in the 10 years between 1994 and 2004, which is 100 on our model. Our index for repayments is currently at 209.77 and for deposits at 191.5.

Rule out changing negative gearing

It’s time for the prime minister to step up and rule out tinkering with the housing market and get on with the job of creating more supply. In particular he must rule out any changes to negative gearing.

Interest rates go up faster than house prices decline

Despite interest rate rises, house prices have retained most of their value, which has led to a decrease in housing affordability across Australia.

Queensland Housing Summit too little, too late

The Queensland Housing Summit was an admission of failure and did nothing to address the real problems in housing affordability in Queensland.