Why would a party whose voters are younger and disproportionately likely to rent propose policies that could see rents increase on average by another $83 per week, as well as seeing as many as 450,000 homes disappearing from the rental market?

Tagged: housing affordability

Faster, Better, More: How to House Australia

Why it takes so long and costs so much to deliver the housing we need – and what we can do about it.

Report criticising using super for home deposits ‘deeply flawed’

The Corinna Economics report on paying for a home deposit using superannuation is convenient for the superannuation industry, but deeply flawed.

Housing affordability index Q2, 2024

The Q4 2024 Australian housing market saw a rise in both the Repayments Index and the Deposit Index after a brief decrease in the first quarter of the year. Levels are back in line with Q4 2023 and the continued upward general trend recorded in Brisbane, Adelaide and Perth more than cancels out the decreases in Canberra, Melbourne and Hobart. Sydney remained unchanged from the previous quarter.

Crisafulli’s budget reply means we have a debate on issues, but not necessarily the right ones

Only a small part of this cost blow-out will be fixed by a regulatory review of the building industry, which, while important, will do nothing to stem the excess demand created by the government.

Housing affordability index Q4 2023

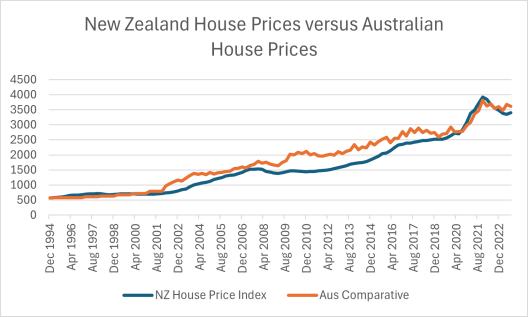

It is twice as expensive to repay the purchase of a house now than for most of the last 30 years with that increase occurring in just the last 3 years since Q3 2020.

Housing affordability index Q1, 2024

Median house prices saw little movement across Australia over the first three months of this year, remaining relatively stable across all capital cities, with most movements limited to 0-2%, with the exceptions of Melbourne, where prices declined by just more than 3%, and Perth where prices increased by 5%.

New home buyer’s tax no way to make housing available or affordable

Shifting the cost of welfare housing on to developers won't fix anything

Access to super for housing deposit won’t cause house price rises

Reality contradicts the “sophisticated” models

|

“Sophisticated modelling” by the Super Member’s Council released today purports to show that allowing Australian’s to access their money in their super accounts to buy a first home would inflate house prices by an average of $75,000.

According to AIP Executive Director, this modelling is rebutted by the facts.

Housing Affordability Index Q3 2023

Overall housing is now twice as unaffordable in terms of repayments, and almost as unaffordable in terms of deposits as it was in the 10 years between 1994 and 2004, which is 100 on our model. Our index for repayments is currently at 209.77 and for deposits at 191.5.