The Corinna Economics report on paying for a home deposit using superannuation is convenient for the superannuation industry, but deeply flawed.

Tagged: superannuation

Access to super for housing deposit won’t cause house price rises

Reality contradicts the “sophisticated” models

|

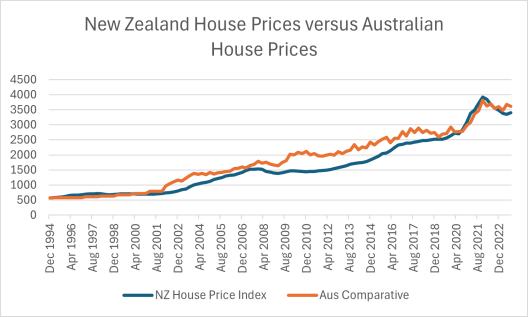

“Sophisticated modelling” by the Super Member’s Council released today purports to show that allowing Australian’s to access their money in their super accounts to buy a first home would inflate house prices by an average of $75,000.

According to AIP Executive Director, this modelling is rebutted by the facts.

Coalition housing policy has lower costs, higher returns to beat Labor policy

It's time we accepted superannuation is not an end in itself but a component of good retirement policy, of which home ownership has to be the cornerstone.

Scheme 6 years overdue

The greatest risk in old age is not that your superannuation balance isn’t high enough, but that you don’t own your own home

Use super savings to solve housing affordability crisis

We've renewed our call for first home buyers to be able to borrow from their superannuation account towards their deposit based on a new study: "Superannuation and Housing: growing the cake and eating it too".

Beware the wounded senior

Retirement income and savings policies could be deciding factors in this coming federal election. Forty-eight per cent of the seats in parliament have a median voter age of 50 years or older.

Report released on Australian attitudes to taxation

Most significantly 56% said they were prepared to pay higher tax. While Greens (75%) were the most generous, even 46% of Liberal voters said they were prepared to pay more.

Time ripe to raise taxes…unfortunately

There is a good argument to keep taxes as low as possible. It’s an argument that is losing ground in modern Australia.